The Business School

Educating business executives since 1965, Durham University Business School is in the heart of the historic city of Durham, on the banks of the River Wear. Our academic excellence and meaningful impact are consistently reflected in our accreditations and global rankings.

What we do

At Durham University Business School, we drive excellence in research, education, and industry engagement. From pioneering research and transformative teaching to strong regional impact and a global network, we shape the future of business and society.

Research excellence

Transformative education

Regional passion

Global community

Industry partnerships

Executive Education

Our vision and mission

Our vision is to lead and inform business thought and practice to enhance equity, prosperity, and well-being. Our mission is to develop and enthuse leaders and entrepreneurs who create, share and use knowledge to deliver equitable and sustainable futures around the world

Professor Kieran Fernandes, Executive Dean of School expands on this, our strengths and our ambitions in his introductory video

Our future

In the next 6 decades, we aim to attain a Top 50 global business school ranking by enhancing research and teaching excellence and graduate employability. We will continue to meet the challenges and demands of the ever-changing global business education landscape and take forward our learnings by integrating cutting-edge technology, contemporary business practices, and leading research into our programmes.

Education and collaboration

Collaboration will remain at the head of our approach to education. We will continue to seek opportunities to develop partnerships with overseas education providers while we continue to expand our executive education and global thought leadership. Business and industry engagement is a fundamental pillar of our strategic vision, underpinning research impact, teaching relevance, and global influence. We will evolve our stakeholder engagement strategy in response to technological advancements, shifting industry needs, and global market dynamics.

The expansion of our executive education and professional development programmes - including micro-credentials, degree apprenticeships, and CPD tailored to regional business needs - will position us as the leading business school for regional economic development, sustainability, and entrepreneurship.

Local and global connectivity

Guided by the philosophy of “local to global” we aspire to remain at the forefront of global business education and research while honouring our rich heritage. Through a steadfast commitment to quality, innovation, and transformation, we will continue to inspire the next generation of leaders, shaping industries and societies worldwide. We will do this by strengthening our global strategic partnerships.

In enterprise and innovation, we will strive to think globally and act locally. Our contributions to the space industry through our European Space Laboratory status will provide new opportunities for innovation and knowledge transfer. This work will also benefit initiatives such as Smart & Scale, supporting North-East SMEs, including those in the growing space sector. Our research will continue to drive impactful outcomes for businesses and organisations of all sizes and across all geographies.

Engagement and research

We will prioritise research with policy and industry impact. Research will strengthen our engagement. On a regional level our insights into sustainability and Net Zero business transformation will help drive the North East and Yorkshire Net Zero Hub and the Tees Valley Hydrogen Initiative. The Durham University Space Research Centre (SPARC) with the School’s input on space policy and sustainability policies will show impact on a multi-national and global scale.

We aim to be a global top five business school for sustainability research and space business innovation. Alongside these we will build on research strengths to be a leading school in Environmental, Social, and Governance (ESG) investment, green finance, carbon markets and circular economy innovations. Our agenda will focus on artificial intelligence (AI), digital transformation, and data-driven decision-making, addressing how AI reshapes business strategy, leadership, and financial decision-making. We will deliver a holistic research-informed view on the future of work will examine workforce automation, digital competencies, and AI-assisted leadership.

Join us as we redefine what is possible in business education worldwide.

Sixty Years of Excellence, Innovation and Impact

We have evolved through decades of growth, innovation, and impact.

1960s – the foundation

Founded as the Durham Business Research Unit in 1960, we became one of the UK’s first business schools in 1965, setting a benchmark for innovation from the start with our first programme, the Modern Management Techniques course. This programme brought research-driven insights directly to businesses in the North East of England. From the outset, we engaged closely with industry.

1970s – championing enterprise development

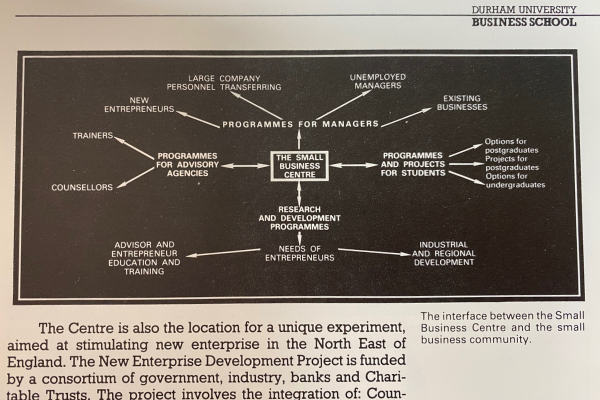

We championed entrepreneurship by establishing the Small Business Centre, supporting Small and Medium-sized Enterprise (SMEs) through workshops and consultancy services. In 1977, the opening of our purpose-built building at Mill Hill Lane provided a dedicated space to deliver transformative education and research. This pivotal year also marked the launch of the School's first enterprise course.

.png)

1980s and 1990s – a global leader in MBAs

In 1986, we set a new standard for business education with the launch of our full-time Master of Business Administration (MBA) programme. Two years later, we pioneered flexible learning with the introduction of our distance-learning MBA. By 1994, we achieved our first AMBA accreditation for all our MBA programmes, affirming our position as a leader in global business education.

.png)

2000s – triple accreditation

The 2000s marked a period of significant growth and innovation. We launched the Durham Doctor of Business programme that extended our influence in executive education. Our crowning achievement came in 2009, when we secured triple-accreditation, earning AACSB accreditation alongside AMBA and EQUIS.

.png)

2010s and 2020s – a leading example

In 2019, the School’s success in international business research and education was recognised as it became the fourth faculty of Durham University. This elevation provided greater access to resources and enhanced our status within the sector. The early 2020s saw the School retain the triple-crown with exemplary 5-year re-accreditations from EQUIS, AMBA and AACSB - a testament to our enduring quality.

Celebrating 60 Years

We reflect on six decades of shaping business leaders and fostering innovation. This milestone is a testament to our dedicated community of students, faculty, and alumni.

/prod01/channel_3/business/media/durham-university-business-school/about-us/About-Us-New-CMS---Banner-image-ideas-Durham-(1920-%C3%83%C2%97-290px)-(1).png)

/prod01/channel_3/business/media/durham-university-business-school/Research-centre-homepage-image.png)

/prod01/channel_3/business/media/durham-university-business-school/about-us/Waterside-2000X800.png)

/prod01/channel_3/business/media/durham-university-business-school/about-us/Durham-City.png)

/prod01/channel_3/business/media/durham-university-business-school/study/Untitled-design-(1).png)

/prod01/channel_3/business/media/durham-university-business-school/for-business/Finance-dept.png)

/prod01/channel_3/business/media/durham-university-business-school/for-business/Untitled-design-(12).png)